The Union Bullion market witnessed a significant correction after the presentation of the Union Budget 2026, bringing much-needed cheer to gold buyers and investors.

Sharp Correction in Retail Prices

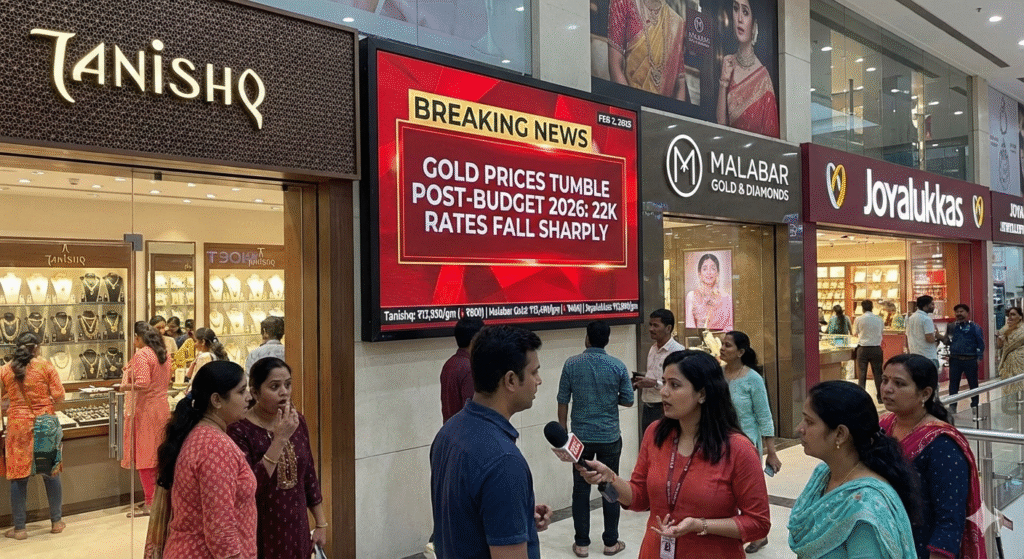

There has been a significant drop in prices among top jewellery brands. Tanishq, one of India’s leading jewellery retailers, saw its 22-carat gold rate decrease to ₹13,930 per gram, down from ₹14,760 on Sunday. This marks a fall of over ₹800 per gram in just one day, surprising many weekend shoppers.

Similarly, Malabar Gold & Diamonds updated its 22-carat gold prices to ₹13,490 per gram, a reduction from the previous day’s rate of ₹13,890. Joyalukkas also aligned its prices with the downward trend, quoting ₹13,890 per gram for 22-carat jewellery. These price adjustments vary slightly across different cities and states due to local taxes and transportation costs, but the overall trajectory remains firmly downward.

IBJA Benchmark Rates Show Steep Decline

The India Bullion and Jewellers Association (IBJA), which provides the benchmark for gold prices in India, reported a broad-based decline across all purities. According to IBJA data:

- Fine Gold (999 purity): Prices fell by ₹643, dropping from ₹14,870 on February 1 to ₹14,227 per gram on February 2.

- 22-Carat Gold: The most popular choice for jewellery fell by ₹627, reaching ₹13,886 per gram.

- 18-Carat Gold: Prices dipped by ₹521, settling at ₹11,524 per gram.

This “Monday Meltdown” in gold prices is being viewed by analysts as a market reaction to the stability offered in the Budget, despite no direct cuts to customs duties on precious metals this year.

The Budget Impact: Sovereign Gold Bonds and Market Sentiment

While the government did not drastically alter the import duty structure for gold, the Budget 2026 introduced pivotal changes to the Sovereign Gold Bond (SGB) scheme. Finance Minister Nirmala Sitharaman announced new taxation rules aimed at streamlining SGB investments.

Under the new rules, the exemption from capital gains tax will now be restricted. Only individuals who subscribe to the bonds during the initial issuance and hold them until maturity will enjoy tax-free gains. For those purchasing SGBs from the secondary market (stock exchanges), any gains will now be taxed at the individual’s applicable income tax slab rates. This move is expected to shift investor focus back toward physical gold and digital gold platforms, potentially influencing retail demand in the coming months.

What This Means for Consumers

For consumers planning weddings or seasonal purchases, the current dip offers a strategic entry point. However, experts remind buyers to factor in additional costs. The final price of jewellery is calculated using the formula:

- Final Price = (Gold Rate x Weight) + Making Charges + GST (3%) + Hallmarking Charges.

With the sharp daily fluctuations, industry insiders suggest that buyers monitor the IBJA rates closely before making high-value purchases. As the market stabilizes post-budget, the current price drop across Tanishq, Malabar, and Joyalukkas marks one of the most significant buying opportunities in the early quarter of 2026.